The prime minister says that a degree should not come with a lifetime of debt. For that goal, the government’s HELP legislation introduced last week is contradictory. It will cut all debt owed as of 1 June 2025 by 20%, which will shorten repayment times for current debtors. But it will also cut annual debt repayments for 99% of debtors, which will lengthen compulsory repayment times for many and push others into the PM’s lifetime of debt.

In the analysis below, female debtors owing $25,000 or more with incomes in the lowest 40% of graduate earnings face an increased risk of a lifetime of student debt. However, what percentage of female debtors actually face a lifetime of debt will depend on initial debt levels and how much their incomes vary through their careers. Voluntary repayments can also affect repayment times.

How the repayment system will change

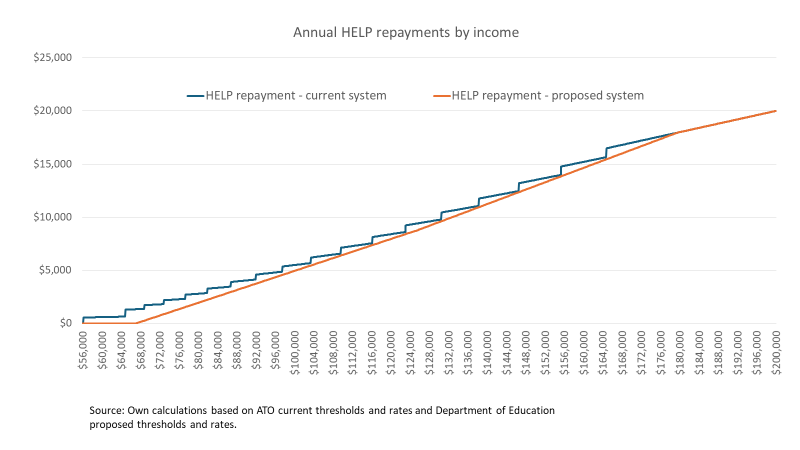

My previous post on the initial threshold summarised how the repayment system will change. The key elements are that 1) repayment exempt incomes will include everyone on $67,000 or less compared to less than $56,156 now and 2) a marginal rather than total income repayment system will reduce what most debtors repay, particularly at lower income levels.

The chart below shows how this will affect HELP debtors at different annual income levels. Based on 2022-23 ATO data I estimate that 99% of debtors repaying under current thresholds will repay less per year than under the current system. The other 1%, all high income earners, will repay the same amount per year as now.