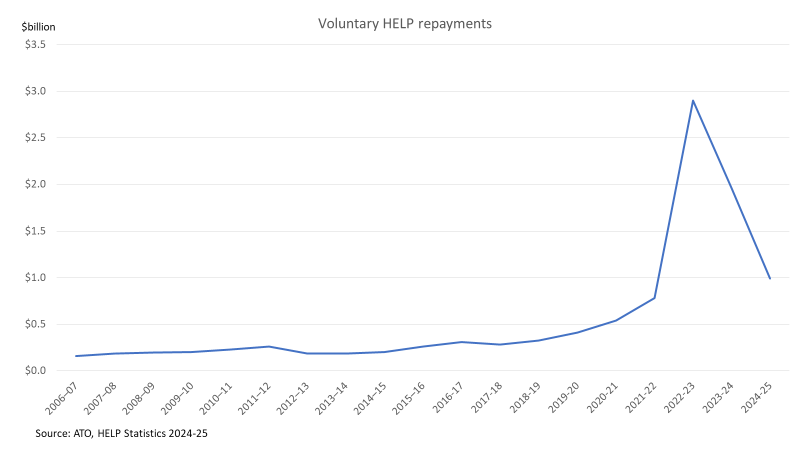

In recent years voluntary HELP repayments increased significantly, peaking at $2.9 billion in 2022-23, before dropping back to $992 million in 2024-25 (according to data released last week). This post looks at why voluntary repayments spiked and what we can expect for future years.

The spike in repayments – indexation

The 2022-23 and 2023-24 big repayment spikes in the chart above are primarily due to people repaying early to avoid high CPI indexation.

With CPI now back to normal levels this should be much less of a factor in the foreseeable future. That said, to reduce indexation costs HELP debtors considering a voluntary repayment should still make it prior to the 1 June indexation date.

The spike in repayments – home loan applications

Aside from indexation, some regulatory issues around treatment of HELP debt led to banks reducing borrowing limits for HELP debtors. Anecdotally this triggered voluntary repayments that may not otherwise have occurred.

APRA has announced two changes that will reduce the impact of HELP debt on mortgages. The first reverses its 2022 decision to include HELP debt in overall lender debt-to-income ratios. The second is that, although HELP repayments should still be included in mortgage serviceability tests, banks can overlook debt likely to be repaid in the near term, such as the next 12 months.

These new rules commence operation on 30 September 2025. Both changes reduce the incentive to repay HELP debt voluntarily.

Expectation of future cuts to HELP debt

Arguably Labor’s 2025 election promise to cut student debt by 20% was one of the most successful vote buying exercises in Australian political history. Although the promise was announced in November 2024, Labor didn’t run hard on it until the last week of the 2025 election campaign. Quite possibly it explained the apparent late swing to the government, at the expense of both the Liberal Opposition and the Greens.

If the 20% cut worked in 2025, will Labor use this strategy again in the election due in 2028?

One reason why wiping debt is an attractive political strategy is its modest impact on the most commonly used budget metric, ‘underlying cash balance’. In the 20% cut legislation explanatory memorandum the government put its cost at $737.7 million, when the true fiscal impact is $9 billion at least. We only have semi-official estimates of its real and significant costs because the Opposition decided to oppose it, which meant that the PBO costed it.

Whether or not Labor uses this strategy again in 2028 it might still affect HELP debtor behaviour, holding off on voluntary repayments in the hope of a future cut. This would add additional costs not counted by the PBO first time around.

Repayments brought forward

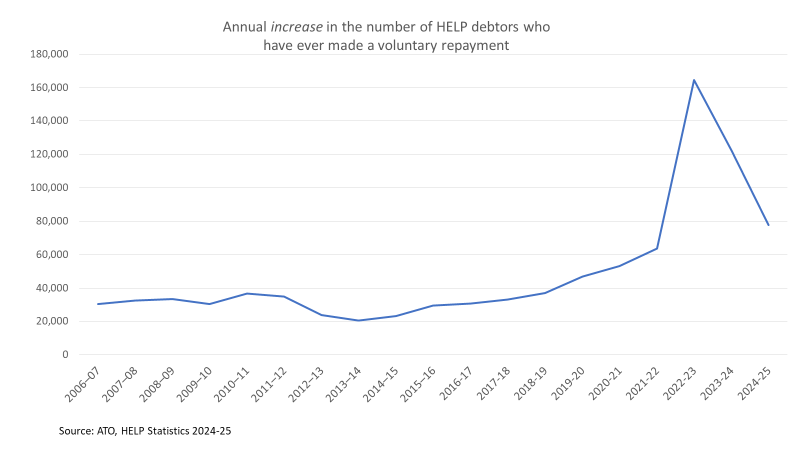

High voluntary repayments for 2022-23 and 2023-24 helped drive up the number of people clearing their debt entirely, reducing how many people are left to repay through either compulsory or voluntary methods in later years.

Flat compulsory repayments in recent years, despite positive graduate employment outcomes in 2022 and 2023 which should otherwise have increased repayments, are consistent with this theory.

Reasons to make voluntary repayments

Despite these four reasons to think voluntary repayments will continue their decline, the repayment system still creates a strong incentive for people near the end of their repayments to clear their HELP debt.

This is because compulsory repayments during a financial year are not recognised as such until after a tax return is processed.

As a result debtors who might only owe small amounts of HELP are technically liable to keep making compulsory repayments for the full financial year, even if these will be way more than what is owed (see this ATO advice and the ATO saying they won’t make variations to PAYG payments if the taxpayer has debts under an Act they administer).

Excess repayments will be refunded after submission of a tax return for the relevant year, but at a potentially high cash flow cost.

It therefore makes good sense to voluntarily clear debts that are below estimated compulsory repayments for the year. Processing of voluntary repayments should happen in 4 days, avoiding the need to wait 12 months or more for a tax refund.

Cohort effects may be increasing voluntary repayments

Despite the repayments-brought-forward theory, the ATO data shows that the number of new people making voluntary repayments in 2024-25 was, at 77,691, still comfortably above the 63,614 new voluntary repayers in 2021-22.

The increase in voluntary repayers since the later 2010s may be an echo of earlier enrolment increases, with more graduates now reaching the end of their loan repayments and/or advancing in their careers and better able to afford voluntary repayments.

Debt management

Anecdotally some people repay HELP debt voluntarily because they want to clear their debt more quickly, whether for psychological reasons or to manage their overall debt position.

The large number of voluntary repayment transactions – nearly 1.1 million in 2024-25 – suggests that there are people chipping away at their HELP debt rather than clearing it all in one lump sum.

Despite the APRA changes reducing recent mortgage-related incentives to repay voluntarily, it remains the case that not having to service a HELP debt will increase home loan borrowing capacity.

The new HELP compulsory repayment system will delay repayment progress, which may encourage some debtors to speed it up again with voluntary repayments.

Conclusion

There are good cash flow and debt management reasons why some people will continue to make voluntary HELP repayments. However the levels seen in 2022-23 and 2023-24 will not be repeated – these were once-off reactions to high inflation and home mortgage issues that are now in the past.