The communique from last Friday’s education ministers meeting stated, in part, that:

The Teacher Education Expert Panel … will focus on strengthening the link between performance and funding of ITE [Initial Teacher Education]. This will include but not be limited to advising on how Commonwealth supported places for teaching should be allocated based on quality and other relevant factors. [Emphasis added.]

This post examines how the government might go about doing this and the problems it would face.

Discipline-level funding under Job-ready Graduates

An initial problem is that the government does not allocate Commonwealth supported places to teaching.

Under section 30-10 of the Higher Education Support Act 2003 the government has no power to allocate student places except for ‘designated courses’, of which more below.

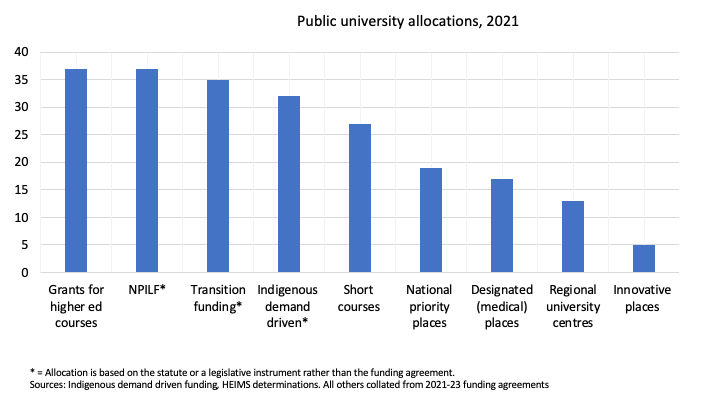

Education is not designated. It is funded under a block grant for ‘higher education courses’. Dollars rather than places are the unit of allocation and the entity that receives the allocation is a higher education institution, not a course or discipline. Recipient universities are free to distribute these dollars between courses according to their own priorities.

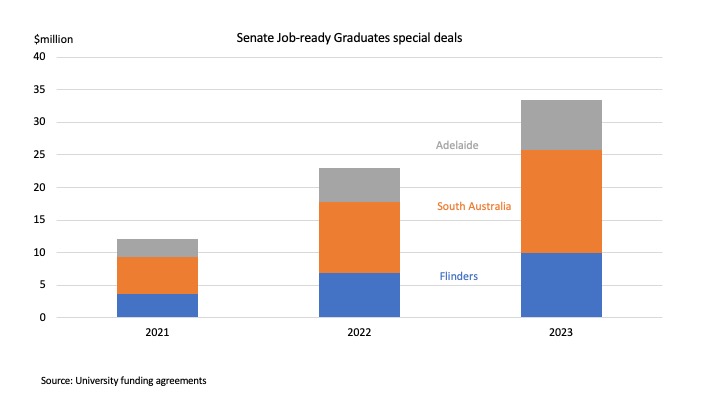

With its COVID-19 short courses the previous government bypassed the restriction on allocating student places by allocating dollars to specific courses instead. Using the funding agreements to quarantine dollars for education would, however, be a bad move. It is inconsistent with the apparent legislative intent, which is for university flexibility except in the case of designation. We need to restore full operation of the rule of law in higher education policy. Without amending HESA 2003 that means designation.

Read More »