To prolong the life of Mapping Australian higher education 2023 I have been updating a spreadsheet which contains the data behind the charts and tables.

The December 2025 Mapping data update is here, revised 2/1/2026 due to an error with FEE-FREE Uni Ready funding in the 16/12/2025 release, is here.

Since the last update in March 2025 the changes include the 2024 enrolment data, the 2024 university financial information, and graduate employment outcomes.

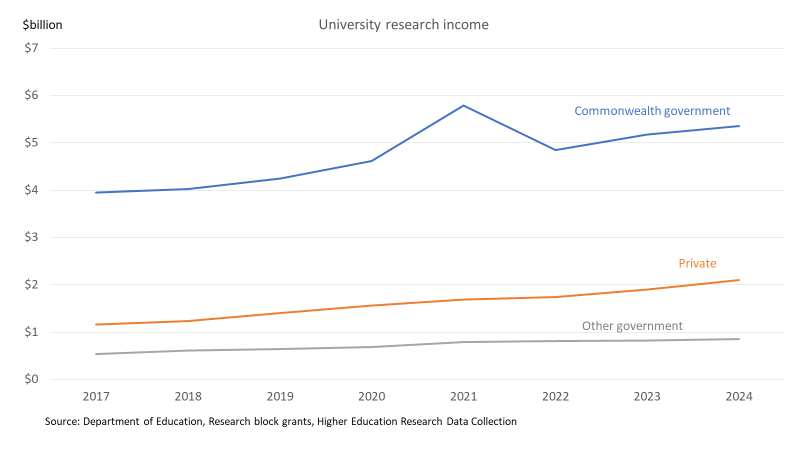

Research income has been the most recent significant data release, including research block grant funding for 2026 and the HERDC data used to calculate it, which goes up to 2024. The chart below shows the research-specific income sources 2017-2024.

I will next update the spreadsheet when we have projected 2026 spending on Commonwealth supported places in the first quarter of 2026. I hope by then the 2025 staff data will also be available.